Changelog (Last updated on May 21, 2025)

May 21, 2025: Updated Password Recovery for Accounts

May 21, 2025: Reflected new changes to both Revenue Share and M&T/Real Estate calculations to include projects less than 5 MW as described in

HB1087

Introduction to SolTax

The Virginia SolTax Tool is designed to help Virginia localities estimate the revenues they could realize under the two distinct solar tax policy options permitted under state law: Machinery and Tools tax (M&T)/Real Estate and Revenue Share. Its purpose is to provide local officials with insights regarding which tax option may provide the greatest financial benefits for a locality.

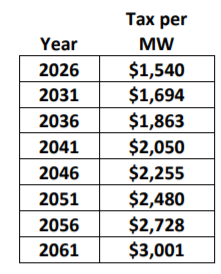

With passage of HB1131 in 2020, Virginia enabled localities to choose between two tax policy options to generate revenues from large-scale solar development. The default option is to levy a Machinery and Tools (M&T)/Real Estate tax on capital investments in solar generation facilities. Alternatively, a locality may adopt a Revenue Share ordinance, which in effect replaces the default M&T option. With a Revenue Share ordinance, localities receive income from solar facilities at a flat rate in dollars per megawatt of nameplate generation capacity per year.

Both tax options have benefits and drawbacks depending on the characteristics of solar facilities expected to be built and the tax rates of the localities where they are being built. This tool permits the adjustment of project specifications as well as the ability to consider new investments in multiple years to allow examination of the revenue implications of alternative scenarios.

The revenues that a locality could realize under each of these two taxation arrangements involve calculations that are non-trivial in complexity. SolTax was developed by the Weldon Cooper Center at UVA, Virginia Energy and others to support local tax policy discussions and decision making.

Login Instructions

To create a new profile, select the Create Account button in the top right corner of the page. This will direct you to a page where

you enter a username, email and password. Once the account is created, you will be asked to select a locality on which to base your initial profile parameters. Once

selected, the locality cannot be changed on a given profile. In order to create new projects associated with another locality's parameters, you should create a new

profile.

If you have already created an account, select Login above.

A Choice Between Two Tax Policy Options

Explore the tabs to learn about the assumptions and calculations involved in the different tax policy options.

Machinery & Tools (M&T)/Real Estate Tax

Machinery & Tools (M&T)/Real Estate Tax is the default mechanism by which localities realize revenues from large-scale solar projects. The tax is calculated as a percentage of the assessed value of certain capital investments made within a locality. In the case of large-scale solar projects, the annual amount of the tax levy depends on several parameters:

- Notional dollar value of the initial capital investment made by project developers

- Schedule of exemptions that apply specifically to utility-scale solar projects per § 58.1-3660 of state law

- Depreciation schedule applied to capital investments, whether applied by the State Corporation Commission or the locality (Whichever is applicable)

- Size of the solar project in MW

- Local M&T tax rate and real estate rate which may vary by locality

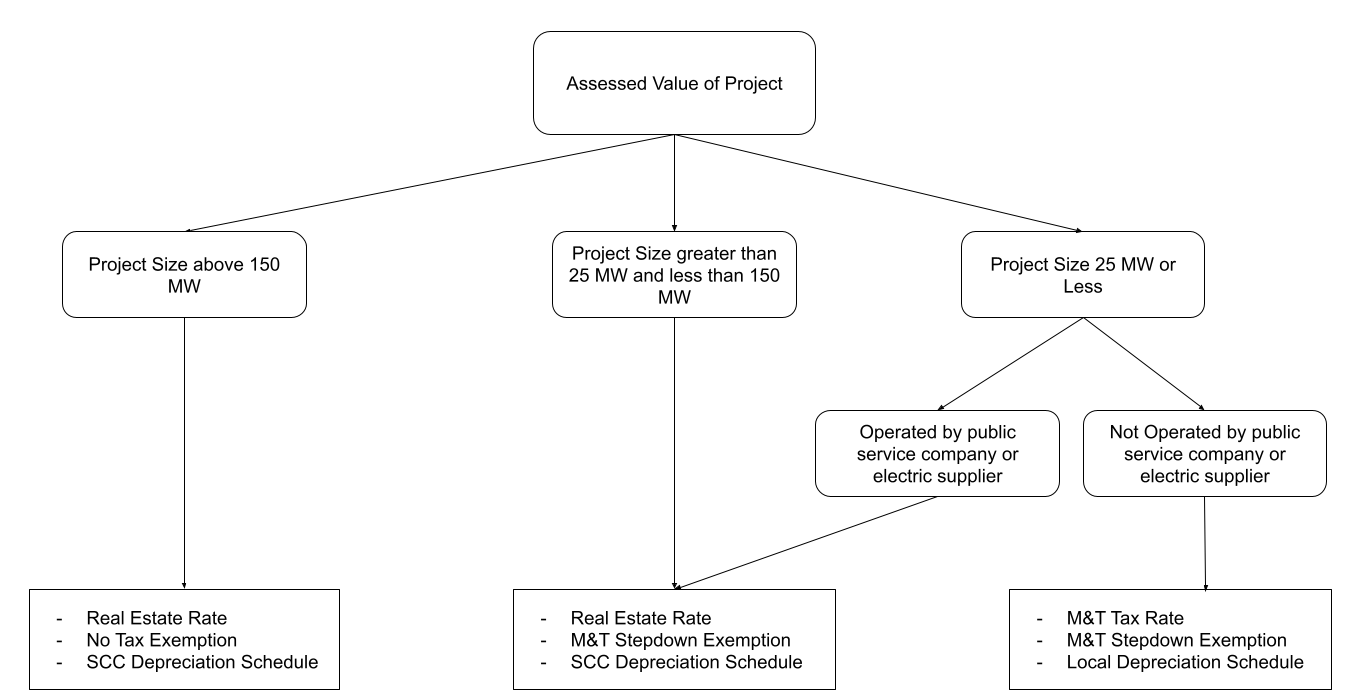

For the M&T/Real Estate tax model, the tax rate, depreciation schedule, and exemption rate applied to projects can vary based on the size of the solar project and who is operating the project.

There are three possible ways the M&T/Real Estate tax model can be applied to a project based on these parameters:

- If a project is 25 MW or less and is not owned by an electric supplier, electric company (Dominion, APCo, or Old Dominion Power) or an electric cooperative, the M&T tax rate is used along with the locality's depreciation schedule and the M&T stepdown exemption rate.

-

If a project is greater than 25 MW and less than 150 MW OR is owned by an electric supplier, electric company (Dominion, APCo, or Old Dominion Power) or an

electric cooperative, the real estate tax rate is applied to the project along with the SCC depreciation schedule, the M&T stepdown exemption rate, and local

assessment ratios. Projects that are less than 25 MW and are owned by electric suppliers are taxed using these parameters in accordance with HB1087. - All projects 150 MW and greater will use the real estate tax rate and the SCC depreciation schedule. There is no mandatory tax exemption applied on these projects.

The 25 MW limit for projects comes from Virginia's definition of an electric supplier as defined in Virginia Code 58.1-2600 and

the local taxation of electric suppliers defined in Virginia Code 58.1-2606 (Paragraph C). These two pieces of legislation state any

electric supplier cannot be taxed at a higher rate than the real property rate, and that an electric supplier is any person operating a facility that generates more than 25 MW of energy.

A breakdown of these categories of projects and their implications can be viewed in the image below.

Computing Cash Flows

The tool will prompt the user to input certain variables, which can be changed to refine the analysis. Based on the variables preloaded in the tool and those provided by the user, the tool will calculate the expected tax revenue for a locality under each of the two tax policy options. Results will be presented side by side, allowing for comparison.

User Entered Variables

These are the variables the User must enter when they Create New Project.

- Initial year the solar project will operate in

- Total capitalized investment into the solar project

- Size of the project in megawatts

- Total acreage of the project

- Total acreage of the project that is "inside the fence"

- Baseline, inside fence, and outside fence land values per acre

- Operation by an electric supplier, electric company (Dominion, APCo, Old Dominion Power) or an electric cooperative

Preloaded Variables

In addition to unique variables the user must enter, locality-specific parameters have been preloaded into SolTax. Preloaded variables are periodically updated by the Cooper Center, however the user may manually update any of these in the tool.

| Variable | Source | Effective Date(s) | Last Updated |

|---|---|---|---|

| Discount Rate | Assumed at 6% (Reference Future Cash Flows to Net Present Value). | 2021 - Present | July 1st, 2021 |

| Real Property Rate | Virginia Annual Local Tax Rates Survey | 2024 | May 14, 2025 |

| M&T Tax Rate | Virginia Annual Local Tax Rates Survey | 2024 | May 14, 2025 |

| Assesment Ratio | Virginia Sales Ratio Study | 2023 | May 14, 2025 |

| Baseline True Value | Virginia Department of Education | 2024-Present | May 14, 2025 |

| Adjusted Gross Income | Virginia Department of Education | 2024-Present | May 14, 2025 |

| Taxable Retail Sales | Virginia Department of Education | 2024-Present | May 14, 2025 |

| Population | Virginia Department of Education | 2024-Present | May 14, 2025 |

| ADM | Virginia Department of Education | 2024-Present | May 14, 2025 |

| Required Local Matching | Virginia Department of Education | 2021 | July 1, 2021 |

| Local Depreciation Rate | Virginia Annual Local Tax Rates Survey | 2024 | May 14, 2025 |

| SCC Depreciation Rate | Virginia State Corporation Commission | 2021 | July 1st, 2021 |

Explore the tabs to learn about the assumptions and calculations involved in calculating cash flows.

Calculating M&T

To calculate the expected tax revenue from the default M&T tax option, the tool will take each year’s expected solar investments from the schedule provided by the user and break their lifetime into three periods that represent each stepdown as articulated in the M&T tax exemption policy, HB 1434. Within each period, the yearly expected tax revenue will be calculated by multiplying the project’s assessed value with the appropriate exemption level (80% exempt in the first 5 years, 70% for the next 5 years, then 60% for the rest of the project’s life) and the effective M&T tax rate for the indicated locality. The effective M&T tax rate is derived by multiplying a locality’s statutory rate per $100 by its depreciation schedule, should it have one.

Acknowledgements

A special thanks is extended to the following people for the guidance and feedback provided throughout the development process of the SolTax application.

- Robert Crockett, Advantus Strategies

- Francis Hodsell, SolUnesco

- Ken Jurman, Virginia Department of Mines, Minerals and Energy

- Joe Lerch, Virginia Association of Counties

- Scott Simpson, Halifax County

- Tom Swartzwelder, King and Queen County

- Bobby Tucker, State Corporation Commission

- Todd Flowers, Dominion Energy

Disclaimer

This is not a forecasting tool. This is a tool is to be used as a consulting tool for localities. The suggestions from models does not constitute legal advice.